10% annual growth in KiwiSaver Funds Under Management

Rainmaker Information

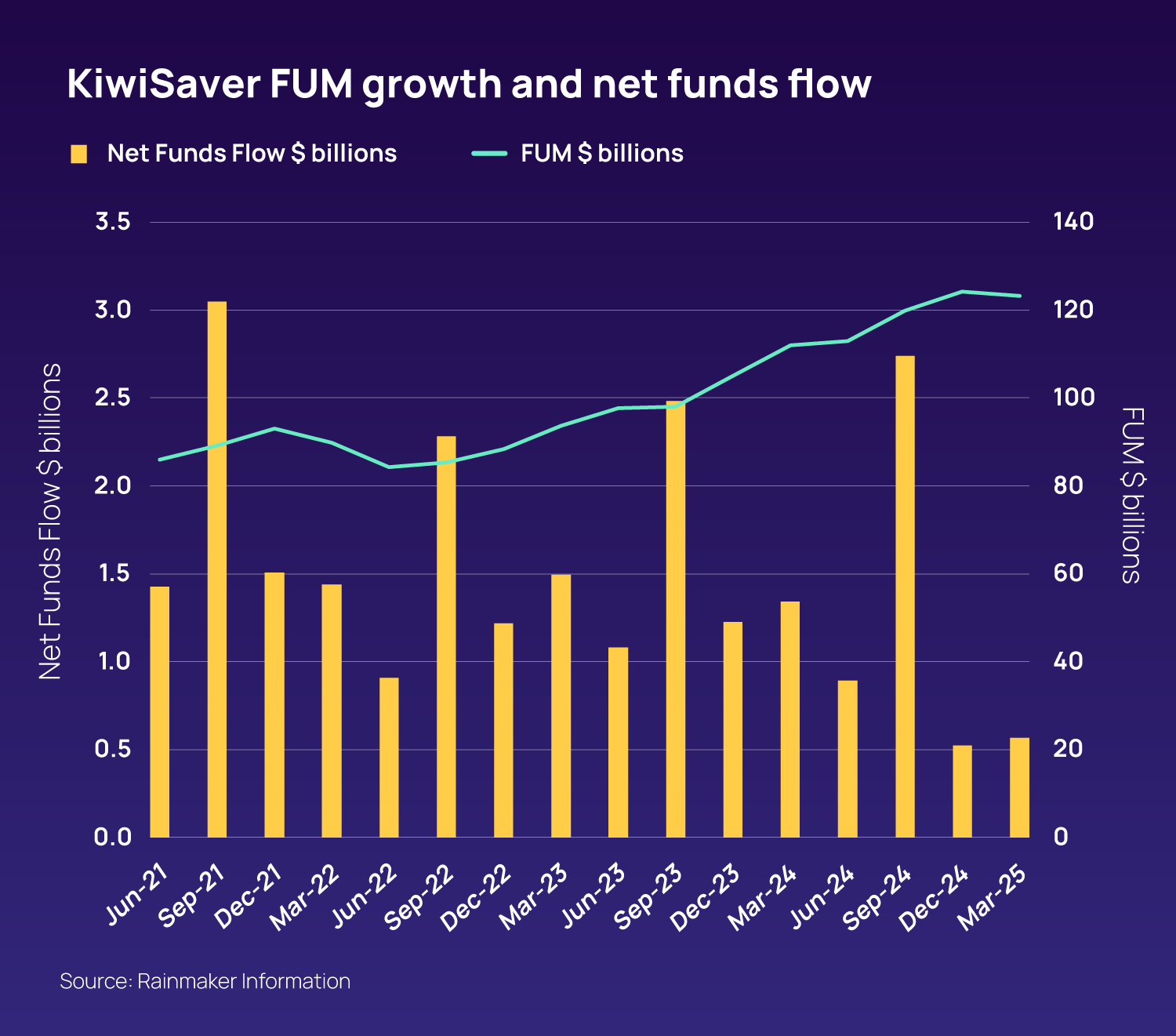

New Zealand’s KiwiSaver scheme has grown from $112 billion to $123 billion in funds under management over the year to 31 March 2025, a growth of 10%.

The $11.2 billion growth was made up of $6.5 billion from investment earnings and $4.7 billion in net funds flowing into the pension scheme, according to the Rainmaker Information PFL New Zealand Report.

KiwiSaver is the dominant product sector in New Zealand, accounting for 58% of total retail funds under management and 40% of inflows.

Over the quarter to 31 March 2025 funds under management declined by $1 billion, a reduction of 0.81%.

The $1 billion quarterly change was made up of investment losses of $1.6 billion and fund inflows of $0.6 billion.

The three-year growth of funds in KiwiSaver sits at 37%.

Of the 28 major KiwiSaver providers, Milford Asset Management had the largest annual growth in dollar figures, up $2.4 billion for a 29.4% growth.

In percentage terms, Nikko Asset Management had the largest growth, with 228.8%, seeing funds under management increase from $26 billion to $84 billion.

The bulk of funds under management (around 88%) is held in multi-asset funds (balanced, growth and capital stable), roughly split 50% growth, 30% balanced and 20% capital stable.

$39.4 billion or 32% of KiwiSaver funds under management is held in default funds (default providers are selected when a member does not select a fund), which rose 9.1% over the year. This is slightly lower than overall market growth.

|

Company |

Mar-25 ($m) |

Mar-24 ($m) |

Annual Change ($m) |

|

Always-Ethical |

79.22 |

73.36 |

5.86 |

|

AMP NZ Group |

7150.23 |

6656.63 |

493.60 |

|

ANZ Investments |

21498.10 |

21031.85 |

466.25 |

|

ASB Group Investments |

18165.60 |

16640.08 |

1525.52 |

|

Booster |

5823.23 |

5245.87 |

577.36 |

|

BT / Westpac NZ Group |

11720.44 |

10987.49 |

732.95 |

|

Christian KiwiSaver Scheme |

97.82 |

97.82 |

0.00 |

|

FirstCape Group |

6254.42 |

5726.61 |

527.81 |

|

Fisher Funds Group |

17728.91 |

16911.14 |

817.77 |

|

Forsyth Barr |

335.17 |

323.63 |

11.54 |

|

FundRock NZ |

476.75 |

310.00 |

166.75 |

|

Generate |

6594.23 |

5307.89 |

1286.34 |

|

InvestNow |

373.99 |

243.79 |

130.20 |

|

Kernel Wealth |

357.91 |

162.27 |

195.64 |

|

kōura Wealth |

269.53 |

158.88 |

110.65 |

|

Maritime Retirement Scheme |

19.05 |

19.05 |

0.00 |

|

MAS |

1410.40 |

1309.75 |

100.65 |

|

Mercer NZ |

2694.10 |

2602.80 |

91.30 |

|

Milford Asset Management |

10569.72 |

8166.02 |

2403.70 |

|

Nikko Asset Management |

83.85 |

25.50 |

58.35 |

|

NZ Funds |

1079.04 |

986.14 |

92.90 |

|

NZX/Smartshares Group |

2860.85 |

2607.85 |

253.00 |

|

Pathfinder |

473.50 |

348.00 |

125.50 |

|

Pie Funds Management |

545.65 |

603.85 |

-58.20 |

|

SBS Wealth |

681.75 |

610.11 |

71.64 |

|

Sharesies |

287.01 |

135.91 |

151.10 |

|

Simplicity |

4944.97 |

4035.40 |

909.57 |

|

SuperEasy |

113.83 |

113.83 |

0.00 |

|

Other Companies |

485.00 |

540.00 |

-55.00 |

|

Total |

123174.2747 |

111981.52 |

11,192.75 |

About us:

About Rainmaker Information

Rainmaker Information, founded in 1992, is a leading Australian-based financial services information publishing house providing marketing intelligence, research, and consulting services on the wealth management industry.

Rainmaker gathers and generates in-depth marketing intelligence with industry research, data, professional development and media capabilities. These resources can be accessed with a subscription to the Rainmaker MarketPro terminal.

Rainmaker Information is owned by Institutional Shareholder Services (ISS) and is part of its ISS Market Intelligence business.

About ISS Market Intelligence

ISS Market Intelligence (MI) is a leading global provider of data, analytics, insights, media, and events solutions to the global financial services industry.

ISS MI empowers global asset and wealth management firms, insurance companies, distributors, service providers, and technology firms by providing cutting-edge market-engagement platforms and the actionable intelligence necessary to fully assess their target markets, identify and analyse the best opportunities within those markets, and execute on comprehensive go-to-market initiatives to grow their business.

ISS MI clients benefit from our increasingly connected global ecosystem that leverages a combination of proprietary data, powerful software and analytics, timely and relevant insights, in-depth research, as well as an extensive suite of industry leading media brands that deliver unmatched market connectivity through news and editorial content, events, training, ratings, and awards.

Contact details:

Julian Clarkstone

P. 02 8234 7514

E. [email protected]