Which Australians are hit by the highest effective marginal tax rates?

HESTA

12 September 2025

New research released by HESTA today reveals older Australians receiving the Age Pension are often subject to staggering effective marginal tax rates of 60% to 80%, disincentivising them from being more active in the workforce. In some extreme cases, these rates can even surpass 100%.

The report by Retirement Essentials, commissioned by HESTA, assessed how employment income affects Age Pension eligibility and take-home pay for older Australians wanting to work.

While Australians in the top income bracket are often considered to pay the nation’s highest tax rates, the findings show age pensioners are hit with far higher effective rates due to the Income Test taper rate. Under this system, a Part Pensioner’s Age Pension benefit is reduced by 50 cents for every dollar earned above the income-free threshold.

HESTA CEO Debby Blakey said the research highlighted the need to provide more flexibility for retirement-age Australians who want to work.

“We recognise the retirement experience of each Australian is unique, and flexibility is important to support both financial and mental wellbeing. That’s why we’re concerned by the significant disincentives within the current system for older Australians who wish to remain active in the workforce,” Ms Blakey said.

“For our members, who are largely in the health and community services sector (HACS), working in retirement has a multitude of benefits for them and the community. Part-time or casual work in retirement helps people retain a sense of purpose and fulfillment, while addressing critical workforce demands and boosting the broader economy.”

Around 70% of HESTA members are employed in the health and community services sector, Australia's second-largest industry and one facing significant staffing challenges amid rising demand in an ageing and growing population.

More than 80,000 HESTA members are currently age-eligible for the pension, with over 30,000 of these members remaining active in the workforce. This demonstrates the significant contribution older Australians continue to make, not only in supporting the health and community services sector, but also in strengthening their own financial resilience and independence.

“We continue to hear stories from members on the pension who would like to work more but are put off by the extreme effective marginal tax rates,” Ms Blakey said.

“By removing barriers, we can unlock greater opportunities for individuals in retirement, while delivering significant benefits to society as a whole.”

To support a fairer system, HESTA is calling for:

- Ensuring retirees’ incentives to work are not diminished by indexing the Work Bonus payments thresholds to Average Weekly Ordinary Time Earnings (AWOTE). The Work Bonus allows those at or over Age Pension age to earn income from part-time, shift, or casual work while retaining more of their pension.

- A review and simplification of the Age Pension Tax Offset rules, which are extremely complex and difficult to understand.

Older Australians depend on various income streams in retirement, with the Age Pension, superannuation drawdowns, and personal savings serving as the three well-established pillars of Australia’s retirement system. Many older Australians would also like to return to the workforce, or stay in the workforce longer, to provide more income.

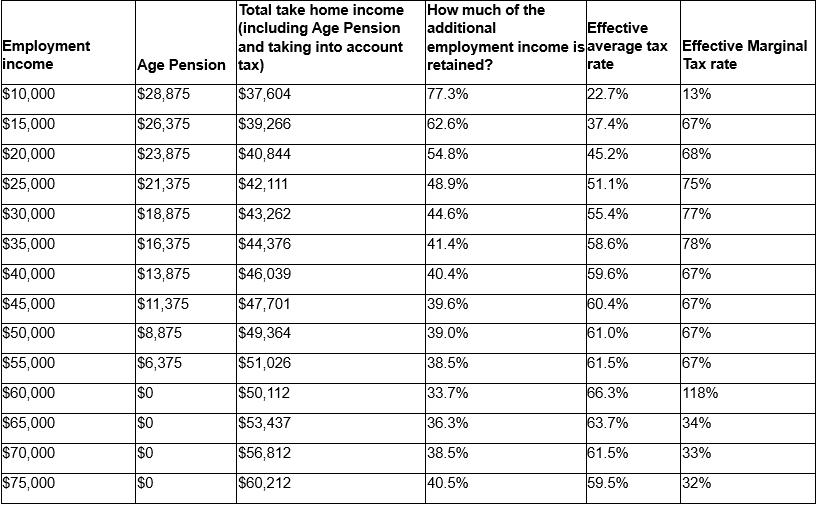

The modelling shows how a single pensioner who increases annual employment income from $25,000 to $30,000 could pay an effective tax rate of 77% on that extra income. As their employment income increases by $5,000, their take-home income rises by just $1,150.

For couples, where only one person goes back to work, the couple also reaches an effective marginal tax rate of 77% at $30,000 of employment income. Where both go back to work, they’re hit with a 64% marginal tax rate when their joint work income reaches $40,000.

Single person example: impact of work income on take home income for 67+ year old with $300,000 in super [1]

- HACS workers best represent issue as they’re predominantly female and may work part-time or take career breaks to raise families, resulting in lower lifetime earnings.

- Around one in four HESTA members are expected to receive a part government Age Pension.

- Factors impacting take-home income of age pensioners who have returned to work include: Income Test Taper Rate; Income Tax Obligations; and Concession Phase-Outs.

Ends.

About HESTA

HESTA is one of the largest superannuation funds dedicated to Australia’s health and community services sector. An industry fund that's run only to benefit members, HESTA now has more than one million members (around 80% of whom are women) and currently manages approximately $98 billion* in assets invested around the world.

*Information is current as at the date of issue.

[1]

Average Effective Tax Rate: compares the change in total (take home) income relative to all employment income. The difference in the change in total (take home) income and the total employment income divided by the total employment is the average effective tax rate. This calculation takes into account the loss of Age Pension benefits a person would get if they didn’t work and includes the impact of any taxes paid due to the work and Age Pension income.

Marginal Effective Tax Rate: compares the change in total (take home) income for the last $5,000 of additional employment income to the ($5000) increase in employment income. The difference in the change in the total (take home) income and the total employment income is the effect of “tax.” Divide that difference by $5000 to get the effective marginal tax rate. This calculation takes into account the loss of Age Pension benefits a person would get if they didn’t work and includes the impact of any taxes paid due to the work and Age Pension income.